Beyond the Casino: The Next Five Years of Solana

For those who know me, you’ll know I’ve been a Solana bull (sometimes to an insufferable degree). This article lays out my core thesis on Solana and where I believe the ecosystem is headed.

In 2021, Solana promised speed. In 2022, it promised redemption. And by 2024, it promised culture.

But as we move deeper into this cycle, a persistent question continues to haunt the conversation around the Solana blockchain: Is this ecosystem anything more than a glorified memecoin casino?

The critics aren’t entirely wrong. From $BONK to $WIF, memecoins have dominated public perception, capturing outsized attention from users, traders, and influencers. It’s easy to conflate short-term noise with long-term irrelevance, but history tells us that ecosystems rarely evolve in straight lines. What looks like a distraction today may lay the groundwork for distribution, experimentation, and eventually—utility.

So where is Solana actually headed over the next five years?

From Throughput to Use Case

Solana was architected for throughput. That was the entire pitch: one global state machine, cheap blockspace, and parallel transaction execution. A chain fast enough to not just keep up with the internet—but to become the internet’s backend.

And while that has enabled viral memecoins and on-chain perps to flourish, the real test is whether the same infrastructure can host more durable value.

We’re already seeing signs:

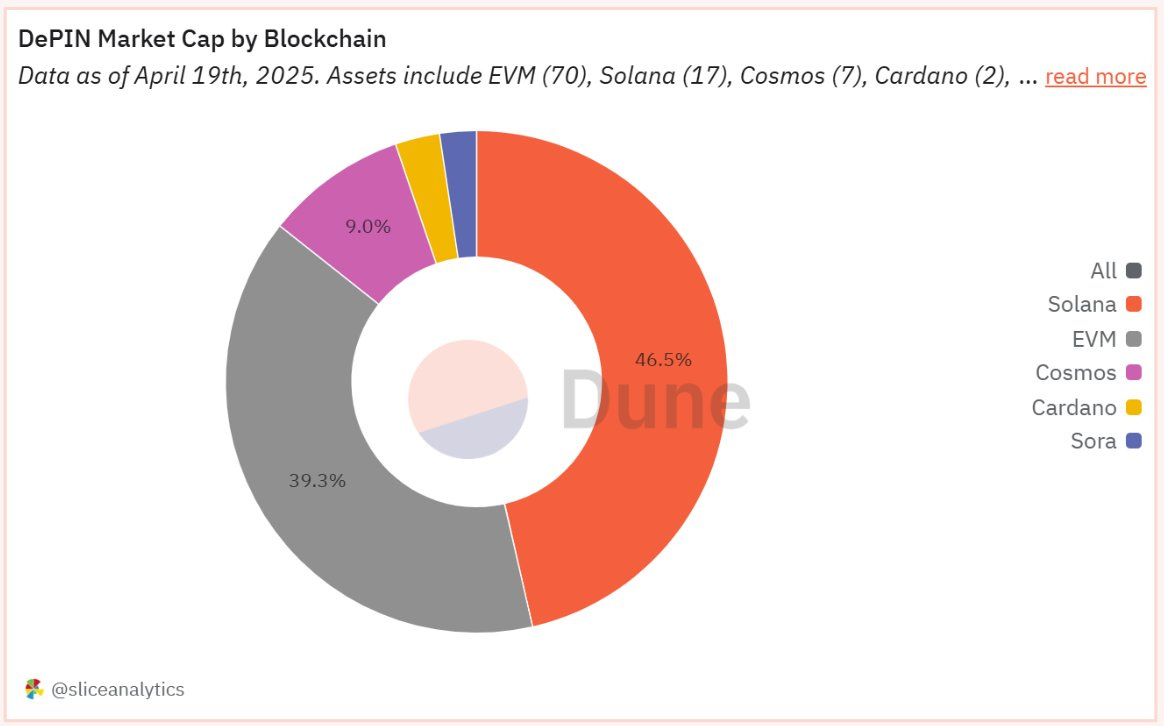

DePINs like Helium and Hivemapper are quietly anchoring physical infrastructure to on-chain coordination—bringing real-world assets into real-time economic systems.

Source: @Dune Solana is becoming a hub for AI x crypto innovation. Agent-based systems where bots interact with smart contracts, marketplaces, and users autonomously are finding a natural fit on Solana. Even Virtuals, a protocol born on Base, expanded to Solana to take advantage of its low latency, composability, and liquidity.

Source: cookie.fun NFT protocols are evolving past monkey JPEGs into on-chain passports for gaming, identity, and community—not just assets you hold, but access you unlock.

Solana’s speed isn’t just good for casinos. It’s good for coordination. It enables feedback loops that feel human, not mechanical—swaps that settle instantly, experiences that don’t break flow, apps that blur the line between Web2 UX and Web3 sovereignty.

In a world moving faster every day, blockchains won’t win because they’re decentralized. They’ll win because they can keep up. Solana’s speed and low fees aren’t just casino-friendly—they’re frictionless enough to support complex coordination, consumer UX, and real-time markets.

Consumer-Scale Distribution

Ethereum has product-market fit with capital. Solana is aiming for culture.

This distinction matters. Capital-first ecosystems build for institutions and DAOs—entities with long time horizons, deep pockets, and a preference for composable finance. Culture-first ecosystems, on the other hand, build for people. They optimize for frictionless onboarding, expressive tools, and viral moments. One scales through governance frameworks. The other scales through memes, creators, and mobile-native apps.

It’s no coincidence that Solana’s most-used apps (e.g. Phantom, Tensor, Jupiter) feel closer to Web2 consumer products than crypto infrastructure. This is not just branding. It’s strategy.

In a world where the next billion users aren’t coming from trading terminals or DeFi dashboards, but from phones, games, and social apps, Solana’s bet is clear: meet people where they are, not where the tech is.

Over the next five years, this will likely crystallize into a new consumer stack:

Mobile-first UX will no longer be an afterthought—it’ll be the baseline.

Social protocols like Dialect will become the connective tissue of on-chain identity.

Chain abstraction will bury the backend—users won’t even know they’re on Solana.

Solana’s superpower isn’t just technical efficiency. It’s cultural fluency. It understands that in the long run, adoption isn’t won through whitepapers and tokenomics—it’s won through touchpoints that feel intuitive, even fun.

In other words: it’s not about Solana being visible. It’s about Solana being usable.

The Casino is a Feature, Not a Bug

Let’s not kid ourselves: speculation is crypto’s most effective go-to-market strategy.

Memecoins are loud and unserious, but they’re also efficient attention engines that do what no user acquisition funnel or grant program ever could—they scale narratives. Like it or not, Solana’s memecoin wave is driving transaction volume, wallet creation, developer interest, and cultural relevance. And it’s doing so without airdrops, rebates, or token incentives. That’s organic liquidity, not mercenary flow. It’s noisy, sure—but it’s real.

Casinos bring liquidity, and liquidity brings life. What separates survivors from the rest isn’t whether they attract gamblers—it’s whether they retain them. Speculation is a foot in the door. The real opportunity is what you build behind it.

Speculation is inevitable, but how ecosystems handle it is what separates Ponzi playgrounds from economic sandboxes. Instead of pretending it doesn't exist, Solana is quietly building the rails to channel it into something more durable.

In the end, it’s not about resisting the casino—it’s about outgrowing it.

Solana’s Strategic Moat

Solana’s true edge isn’t just tech—it’s coordination.

In a space obsessed with modularity and maximalist ideology, Solana’s monolithic approach often gets dismissed as a design compromise. But what if the real advantage isn’t architectural at all—but operational?

The Solana Foundation acts with clarity, setting long-term priorities and funding R&D. It doesn’t try to chase hype cycles—it sets the tempo. Whether it’s allocating grant capital toward mobile-first UX, improving validator incentives, or subsidizing critical infrastructure like RPC providers and client diversity, the Foundation operates more like a venture studio than a think tank.

This clarity of mission—combined with deliberate pacing—allows the ecosystem to move with strategic intent rather than reactive chaos. In an industry where most L1 teams are either absent or overbearing, Solana’s Foundation hits a rare middle ground: supportive but not suffocating.

The ecosystem narrative is sensible, even if messy. Solana doesn’t have the polished brand control of Ethereum or the ideological purity of Bitcoin. What it has instead is momentum. There’s an emergent coherence to what’s being built: fast apps, cheap UX, global onboarding. Whether it’s DeFi, DePIN, gaming, or AI, the connective tissue is usability at scale. You may not always agree with the noise, but you can’t deny the signal: Solana is building for the end user, not the niche governance token holder.

The narrative isn’t perfect—but it’s working, and that might be more important than purity.

The developers are shipping and now have access to better documentation, TypeScript SDKs, and growth capital than ever before. It wasn’t always this way. Solana’s early developer experience was notoriously unforgiving—Rust-only, limited tooling, and poor onboarding. But that’s changed fast.

This is what a credible flywheel looks like: better tools → more devs → better apps → more users → more capital → repeat.

That’s not something you can fork. Coordination compounds, and five years from now, Solana could become the default chain for anyone building real-time, consumer-scale apps—not because it wins every narrative war, but because it wins every product demo.

The Numbers Don’t Lie

Critics may scoff at Solana’s memecoin mania, but the data tells a different story. Let’s break down a few key metrics from Blockworks’ Solana analytics dashboard.

Solana’s Q4 2024 and Q1 2025 performances were by far the blockchain’s strongest to date. Total application revenue, or Chain GDP, grew by 321% quarter-over-quarter, reaching $825M by the end of 2024. That momentum carried into the new year, with Q1 2025 recording $819M in revenue. January alone accounted for $551M—driven largely by the infamous $TRUMP coin launch. To put it in perspective, Solana earned more in a single quarter than it did in entire years prior.

What this implies is product-market fit at the protocol layer. Solana isn’t just facilitating transactions—it’s capturing value from them. That’s a sign of economic maturity. When protocol-level GDP grows this fast, it invites a second-order effect: investor confidence, developer migration, and long-term sustainability.

Just one year ago, Solana DeFi was seen as a ghost town. Today, it’s a capital hub. At the time of writing, Solana holds $9.6B in DeFi TVL—just 19% below its January 2025 peak. Many had written off the blockchain after the $LIBRA fiasco, declaring it dead. But liquidity is returning with conviction, and the fundamentals are only getting stronger.

This isn’t just passive liquidity sitting in pools—it’s active capital, being routed through perps markets, DEXs, and dynamic vaults. This growth marks two important turning points:

Restored institutional confidence - TVL at this scale means whales, treasuries, and funds are deploying size.

Resilient infra - You don’t reach these levels of capital without battle-tested architecture. Solana’s validator set, client improvements, and composability are finally converging into something stable enough for serious DeFi to thrive.

This wasn’t luck. It was rebuild-and-repeat.

Tailwinds Turning the Tide

While Solana has faced its share of headwinds, several emerging tailwinds are poised to propel the ecosystem forward.

Institutional demand - Solana has quietly emerged as a favorite among institutions—not just for its speed, but for the strength of its fundamentals. It’s now widely considered one of the top contenders for the next spot crypto ETF in the U.S. The likes of VanEck, Bitwise, Canary, and Grayscale currently have pending applications, with the earliest approval potentially coming as soon as October 2025. Canada also launched several spot Solana ETFs on the Toronto Stock Exchange in April, pulling in over $86M in net inflows within their first week.

We’re also starting to see institutional appetite materialize elsewhere. SOL Strategies, taking a page from (Micro)Strategy’s Bitcoin treasury playbook, announced a $500M convertible note facility aimed at building a Solana-focused investment vehicle. While significantly smaller than Saylor’s war chest, it’s a promising start and further evidence of growing demand for the asset.

Regulatory support - There has never been a better setup for crypto. We are, by far, in the most bullish environment the industry has ever seen. The regulatory landscape in the U.S. is finally clearing up, paving the way for major catalysts like the U.S. Digital Asset Stockpile (which includes Solana), helping cement the legitimacy of the asset class. This shift opens the door to faster development cycles and greater investor confidence.

Performance buffs - Firedancer’s mainnet debut, expected later this year, could mark a defining moment in Solana’s evolution. Built from the ground up by Jump Crypto, it promises to take what’s already one of the fastest blockchains and push the ceiling even higher—exponentially increasing throughput, hardening network reliability, and unlocking new use cases like high-frequency trading. Just as important, it introduces a second independent validator client, a quiet but crucial step toward true decentralization. If it delivers, Firedancer won’t just make Solana faster. It’ll make it stronger.

Source: @0xMert_

Conclusion

Solana will always have a casino, but casinos don’t preclude innovation—they subsidize it. They onboard users, stress-test infrastructure, and generate the liquidity that gives rise to everything else. The meme coins, the degens, the yield-chasers—they're part of the story, not a detour from it.

The next five years won’t be about running from that identity. They’ll be about maturing beyond it. If Solana can layer permanence over play—building systems that reward long-term alignment as much as short-term speculation—then it has a shot at something rare: becoming a chain that doesn’t just scale transactions, but scales trust.

Because underneath the noise, the building continues. Firedancer is coming. Real-world adoption is stirring. Capital is circling back. And if the culture holds, then it won’t just be the fastest blockchain in crypto.

It will be the one that wins.

“Even when innovation doesn’t start on Solana, it eventually finds its way there.”

- Cosmo Jiang and Eric Wallach, Pantera